Our Wealth Mission: Provide Income-Focused Real Estate Investments.

$93M

Funds raised

60%

Repeat Investors

$2.3B

Assets Under management

48

Properties

Introducing: The WMG Cashflow Fund I

Real Estate-Backed Investments Designed for Monthly Income.

The Wealth Mission Group (WMG) Fund was created with one primary goal: to provide investors with consistent, predictable cash flow that is paid monthly.

Why this matters

Many real estate funds rely on asset sales for investor returns, but WMG is focused on generating cash flow first so investors don’t have to wait for an exit.

Long-term passive income strategy

By targeting cash-flowing real estate assets and structured lending opportunities, WMG ensures that investor capital works for them immediately.

Asset types included in the fund

Fix-and-Flip Money

Short-term lending opportunities for flippers.

Multifamily & Commercial Loans

Providing structured financing for operators.

Private Credit

High-yield debt financing for real estate projects.

Strategic Partnerships

Investments in stabilized assets.

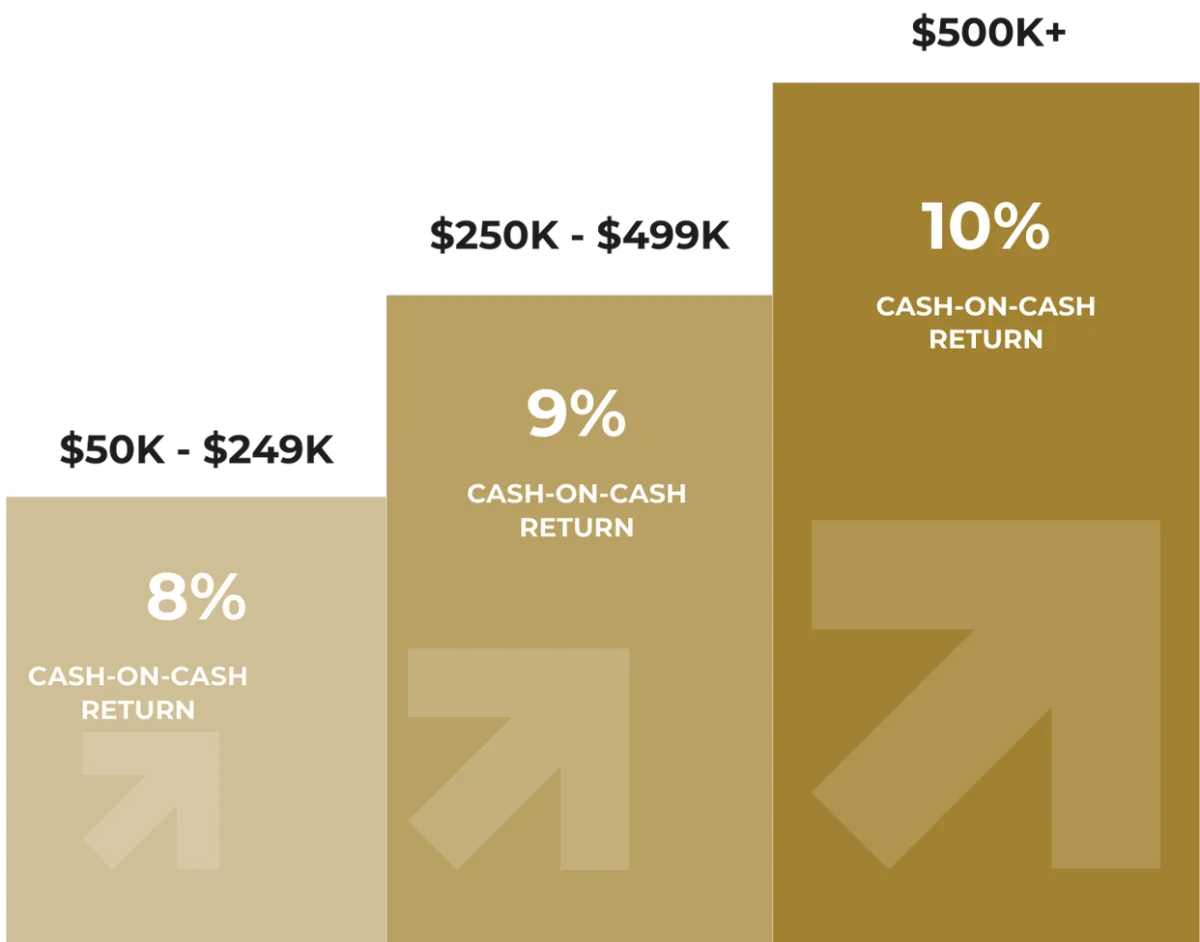

Investor Tiers and Fund Highlights

MONTHLY DISTRIBUTIONS

Targeted monthly income begins approximately 60–90 days after investment, depending on deployment timing.

12-MONTH COMMITMENT

Investors may request withdrawals after 12 months, subject to fund terms and processing timelines (typically up to 60 days).

STARTING INVESTMENT

$50,000 minimum to participate. Tier 1 is structured to target an 8% annual cash-on-cash return, distributed monthly.

Our Fund Strategy

Focused on Real Estate Lending

We don’t buy or manage the properties—we fund them. WMG serves as a private lender for experienced real estate operators including value-add developers, commercial converters, and fix-and-flip specialists.

Structured for Reliable Income

By structuring first-position loans, WMG seeks to generate monthly interest payments. As the lender, we are paid before equity stakeholders, which supports our goal of delivering consistent monthly distributions to investors.

How We Mitigate Risk

We lend exclusively to experienced operators who undergo a thorough vetting process. All loans are secured by real estate assets in first position. In the event of a default, WMG has the right to take possession of the property, which may offer a path to recover investor capital, depending on market conditions and asset performance.

How It Works:

Build Wealth in Three Easy Steps

1

Become an Investor

Schedule a meeting with our team or fill out the investor application form. Accredited investors only

2

We Activate Your Capital

We put your capital to work through our secured lending strategies.

3

Put Your Investment Income to Use

Receive monthly distributions and enjoy the benefits of income-focused investing.

Enrollment open to accredited investors only.

Not sure if you qualify? Book a call with our team.

Key Features of WMG’s Cash Flow Model

Monthly Distributions

Our strategy is designed to produce monthly distributions to investors, based on interest income from secured lending.

No Dependence on Appreciation or Sale

Our lending strategy is not reliant on property appreciation or asset sales. Investor returns are targeted through monthly interest payments from active loans.

Conservative Lending Structure

We lend at conservative loan-to-value ratios to thoroughly vetted operators. Our first-position lien structure provides seniority in repayment, and all loans are secured by real estate collateral.

12-Month Commitment with Withdrawal Option

After the initial 12-month period, investors may request withdrawals, subject to fund availability and a standard processing window of up to 60 days.

Your Capital Deserves More Than Hope and Market Swings.

Our secured lending model is built for investors who want consistency, transparency, and monthly income—without riding the ups and downs of traditional markets.

Book a call to learn more & ask questions

Review fund details to get started.

THE INFORMATION ON THIS WEBSITE DOES NOT CONSTITUTE A RECOMMENDATION, AN OFFER TO SELL, OR A SOLICITATION OF AN OFFER TO BUY, ANY INVESTMENT PRODUCT, NOR SHALL THERE BE ANY OFFER, SOLICITATION, OR SALE OF ANY INVESTMENT PRODUCT IN ANY STATE OR JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER SECURITIES LAWS OF ANY SUCH STATE OR JURISDICTION. THE CONTENT CONTAINED ON THIS WEBSITE IS FOR INFORMATIONAL PURPOSES ONLY AND INVESTORS SHOULD SEEK INDEPENDENT LEGAL, ACCOUNTING, TAX AND OTHER RELEVANT PROFESSIONAL ADVICE. ANY OFFER OR SOLICITATION WILL BE MADE ONLY BY MEANS OF A PRIVATE PLACEMENT MEMORANDUM (THE “PPM”) TO ACCREDITED INVESTORS. THIS WEBSITE EXCLUDES MATERIAL INFORMATION DETAILED IN THE PPM, INCLUDING, BUT NOT LIMITED TO, RISK FACTORS. THERE CAN BE NO ASSURANCE THAT THE OBJECTIVES STATED IN THE PPM WILL BE MET, OR THAT INVESTED CAPITAL WILL BE RETURNED. THIS WEBSITE MAY CONTAIN FORWARD LOOKING STATEMENTS, AND THE PPM MAY INCLUDE FORECASTS AND PROJECTIONS, BOTH OF WHICH, BY THEIR VERY NATURE, ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE PROJECTED AND RESULTS MAY VARY SUBSTANTIALLY OVER TIME AND FROM PERIOD TO PERIOD. PAST PERFORMANCE IS NOT AN INDICATION OR GUARANTEE OF FUTURE PERFORMANCE. INVESTMENTS ARE NOT BANK DEPOSITS (AND THUS ARE NOT INSURED BY THE FDIC OR BY ANY OTHER FEDERAL GOVERNMENTAL AGENCY), ARE NOT GUARANTEED, AND MAY LOSE VALUE. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY HAS RECOMMENDED OR APPROVED ANY INVESTMENT OR THE ACCURACY OR COMPLETENESS OF ANY OF THE INFORMATION OR MATERIALS PROVIDED ON THIS WEBSITE.